In 2025, the growth of video games was supported by the depth of engagement, not just the volume of releases. What do the data from January to November 2025 tell us so far in the Newzoo analysis?

The state of gaming in 2025: initial analyses from this year’s data

2025 was an exceptional year for video game releases. A rich range of premium titles, the launch of Nintendo’s Switch 2, and the constant momentum of mobile gaming combined to generate market growth exceeding expectations.

While the video game industry has faced continuous pressures on the development and publishing front, including reorganizations and studio closures, the consumer side of the market has remained resilient. Player engagement and spending have remained stable across successful franchises, premium releases, and live service titles, positioning the sector to close the year on solid ground.

The data from Newzoo’s Global Games Market Report and Forecasts for November 2025 confirms that the market has exceeded previous expectations. With the December results yet to be published and the annual data expected in January, this article provides an early analysis of the gaming market’s performance since the beginning of the year, using data from January to November 2025 to identify trends that are already characterizing 2025.

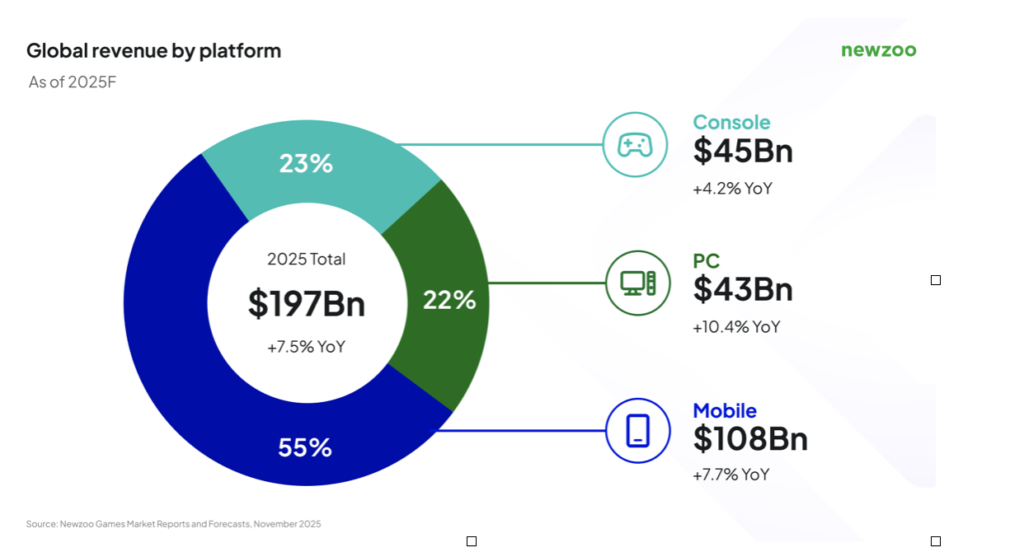

A record of 197 billion dollars in 2025.

It is expected that the global video game market will reach 197 billion dollars by 2025, with a growth of +7.5% year on year. This represents a revision upward from previous forecasts, driven mainly by better-than-expected performances on PC and mobile devices.Si prevede che il mercato globale dei videogiochi raggiungerà i 197 miliardi di dollari nel 2025, con una crescita del +7,5% su base annua. Questo rappresenta una revisione al rialzo rispetto alle previsioni precedenti, trainata principalmente da performance migliori del previsto su PC e dispositivi mobili.

Mobile gaming is expected to generate $108 billion (+7.7% year-on-year), supported by new successes and resilient evergreen titles. Publishers like Century Games and Tencent have shown that midcore mobile experiences continue to capture attention and spending. The second consecutive year of growth in mobile indicates that the segment has stabilized after the post-pandemic normalization.

Console gaming is expected to reach 45 billion dollars (+4.2% year-on-year). The growth has been supported by the launch of Nintendo Switch 2 and a packed release calendar for established franchises.

It is expected that PC gaming will generate 43 billion dollars (+10.4% year over year). A wide range of premium releases has surpassed last year’s great successes, demonstrating that high-quality premium content can still succeed on PC despite increasing competition.

Come osserva Michiel Buijsman, Principal Market Analyst, “i risultati del 2025 riflettono una maggiore spesa da parte dei giocatori nei giochi e negli ecosistemi che già apprezzano, piuttosto che una crescita guidata da un’improvvisa espansione della base di giocatori”.

Uscite del 2025: i giochi più performanti per fatturato e coinvolgimento

Utilizzando il Game Performance Monitor di Newzoo, abbiamo monitorato le principali uscite di giochi per PC in termini di fatturato in sei mercati occidentali (USA, Regno Unito, Francia, Germania, Italia, Spagna) da gennaio a novembre 2025.

Principali conclusioni dal PC

Le uscite premium hanno trainato la crescita del fatturato su PC. Tutti i titoli nella top 10 erano giochi premium, rafforzando il ruolo dei lanci a prezzo pieno nelle prestazioni PC di quest’anno.

PC continues to provide space for AA studios and new IPs. Titles like ARC Raiders, Schedule I, R.E.P.O., and Dune: Awakening have secured spots in the top 10, highlighting the relative openness of PC to new IPs and system-driven design.

Gender diversity remains a strength of PC. The top 10 included six genres, reflecting a strong demand for diverse experiences.

Gli sparatutto si sono confermati il genere più diffuso su PC, offrendo diverse possibilità di successo tra design tattici, cooperativi e basati sul looter.

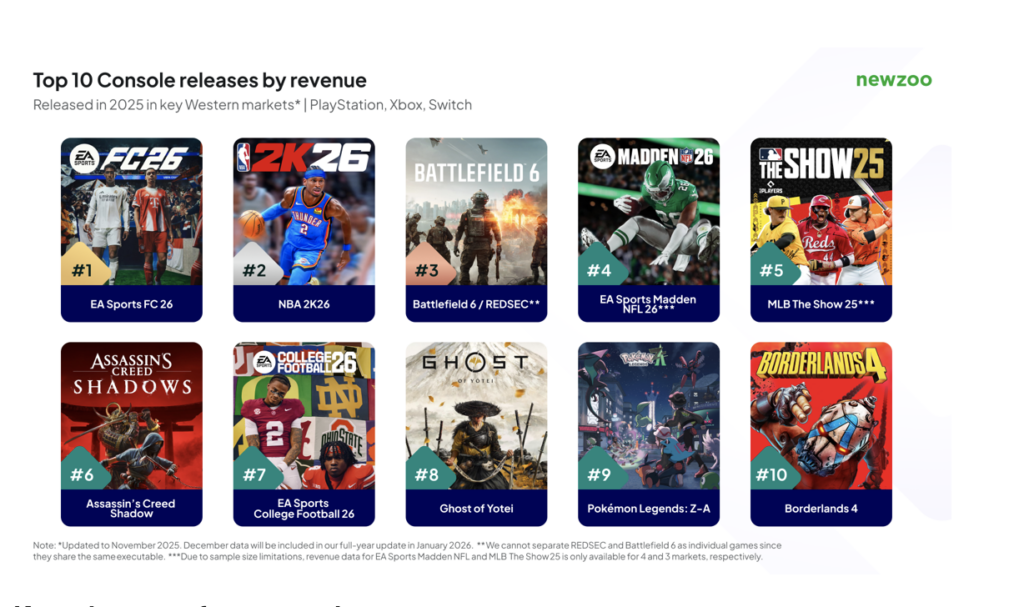

Shooters have confirmed themselves as the most widespread genre on PC, offering various opportunities for success among tactical, cooperative, and looter-based designs.Spostando la nostra analisi sulle console, vediamo i principali giochi per console per fatturato usciti nel 2025 su PlayStation, Xbox e Nintendo Switch.

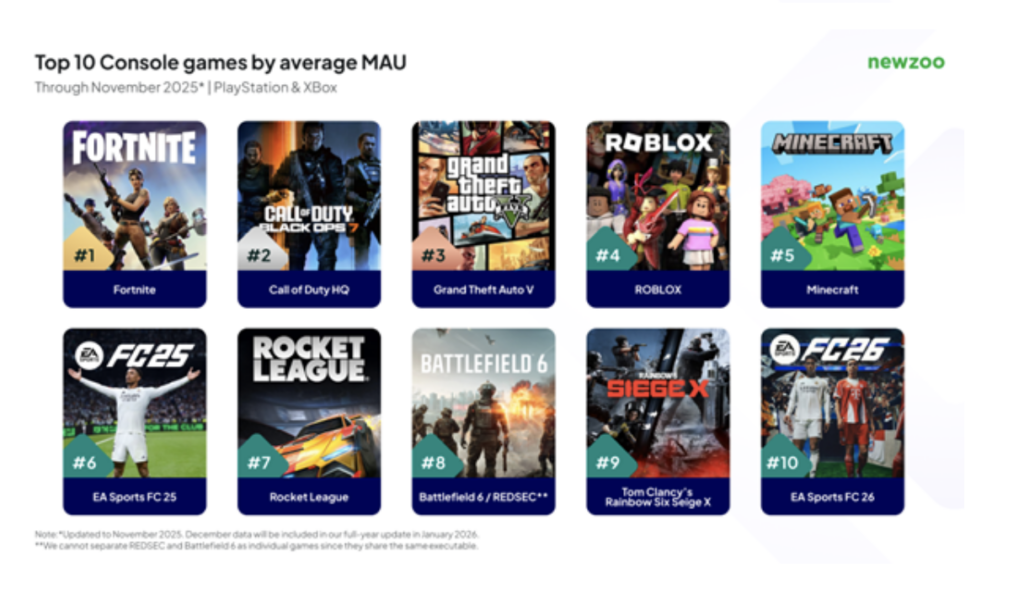

Key takeaways from the consoles

AAA franchises dominated the top 10 console, with major publishers and established IPs capturing most of the revenue. Electronic Arts led the ranking with four titles, driven by its sports portfolio and a strong premium launch strategy.

I titoli sportivi hanno conquistato metà della top 10 console, tutti franchise annualizzati, rafforzando la forza duratura del gioco abituale e dei cicli di lancio prevedibili su console.

L’esclusività della piattaforma è ancora importante. Pokémon Legends: Z-A si è classificato al nono posto per fatturato nonostante il lancio su una singola piattaforma, con circa la metà delle vendite provenienti da Switch 2.

Overall, the PC and console rankings illustrate a clear divide based on where value is created. The PC rewards variety, depth, and new IPs, while console revenues remain anchored to scale, franchises, and habitual gameplay.

Next, we will examine player engagement to understand where gameplay time was focused in the 2025 releases.

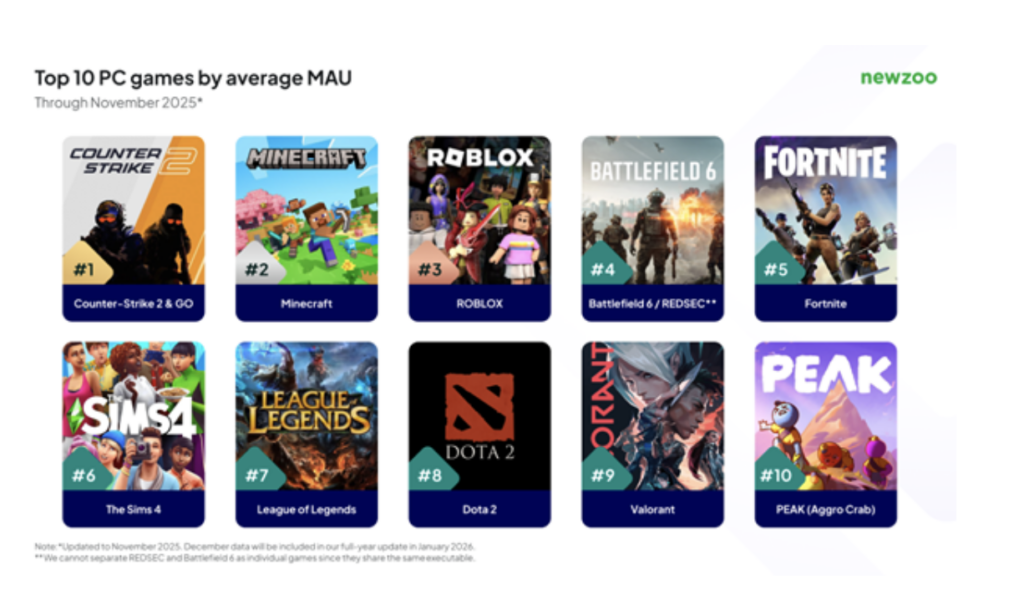

Key information on engagement on PC and consoles

Live service titles have dominated the MAU rankings on both PC and console. Games like Fortnite, Minecraft, and Roblox continue to function as platforms, supported by constant updates, social systems, and creator ecosystems. Only one release from 2025 has entered the top 10 for MAU across all platforms, driven by a free-to-play expansion that significantly broadened the reach post-launch.

Le preferenze per gli sparatutto differivano a seconda della piattaforma. Gli sparatutto per PC enfatizzano maestria e precisione, mentre gli sparatutto per console tendono maggiormente all’accessibilità e alla familiarità con il franchise.

Annual franchises have performed better on consoles than on PC, reflecting different engagement patterns between the platforms.

Overall, the engagement data reinforces a recurring theme starting from 2025. Sustained gameplay time and continuous content had a greater impact on long-term attention than just the launch moment.

The titles that influenced the market in 2025.

This news has dominated industry headlines this year. Our analysts have examined what they reveal about actual market behavior.

Grand Theft Auto VI and the power of blockbusters.

Rockstar’s decision to delay Grand Theft Auto VI until 2026 has dominated the headlines. Our latest report and forecasts on the global video game market have shown that the impact has primarily been a rescheduling of spending rather than a reduction in demand. Consoles account for about a quarter of the global video game software revenue, which means that even the most important releases influence the timing of spending more than whether spending occurs.

This dynamic is visible in engagement. Grand Theft Auto V has remained among the top 10 titles for PC and console according to MAU in 2025, despite the launch being more than ten years ago. As Manu Rosier, Director of Market Intelligence, explained to IGN, the delay highlighted how the ambition of AAA titles is increasingly intersecting with production constraints.

Nintendo Switch 2 and the premium value on consoles.

The launch of Switch 2 has sparked an immediate debate. In our initial analysis of the digital performance of Switch 2, the data from Game Performance Monitor (eShop only) showed that some third-party titles generated significant revenue and engagement during the launch window in six key markets.

While proprietary titles have consolidated the platform, Deltarune led digital unit sales at launch, and No Man’s Sky and Cyberpunk 2077 ranked among the best in terms of digital revenues during the launch window. Together, these signals demonstrate that well-optimized and differentiated third-party titles can generate significant engagement and spending on Switch 2, particularly where players perceive clear value.

The end of the era of publishers as we knew them.

EA’s deal to go private, along with other major acquisitions in 2025, marked a clear turning point for Western publishing. It was not a struggling exit. EA began the transition from a position of strength, ranking first for MAU in August 2025, with 53.6 million monthly active users in the markets monitored by Newzoo.

As Manu Rosier, director of market intelligence at Newzoo, commented, “the agreement with EA reflects a broader structural shift towards the concentration of ownership and a more rigorous management of the portfolio. A smaller number of companies now control a larger share of the industry’s most influential intellectual property, while platforms are increasingly determining which games are financed, distributed, and scaled.”

This analysis is in line with Matthew Ball’s recent opinion on the EA operation, which frames the deal as part of a long-term power rebalancing between publishers, platforms, and capital.

These perspectives conclude that the competitive dynamics that characterized the last generation of Western mega-publishers are giving way to a more consolidated market structure influenced by platforms.Queste prospettive concludono che le dinamiche competitive che hanno caratterizzato l’ultima generazione di mega-editori occidentali stanno cedendo il passo a una struttura di mercato più consolidata e influenzata dalle piattaforme.

Looking to the future.

Industry movements in 2025 show that growth has been driven less by the timing of major launches and more by long-term commitment, pricing power, and established franchises. Market momentum is increasingly driven by depth rather than volume.